New Student Orientation Training Page - Jackie

New Student Orientation: Cost, Payment, and Aid

Summer 2020 Presentation Information

For more information on New Student Orientation, visit the New Student Orientation website.

For the parents, families, and guests who attended our presentations at Orientation, thank you for coming! Here you can find the helpful information, tips and tricks, and websites shared during the presentation.

Follow us on Facebook, Twitter, and Instagram. We post scholarship opportunities, money tips, and important reminders that can help you and your student stay on track for financial aid, scholarships, billing, and more!

Also, see our special Parents page that addresses financial aid topics that parents and families often have questions on.

How Do Parents/Guests Access a Student's Account Information?

How Can We Plan for Fall Charges?

When and How Can I See My Charges?

What If Financial Aid Doesn't Cover the Full Balance Due? What Are Other Options?

- Scholarships

- College Savings Plan (529, Prepaid College Plan)

- Part-Time Student Jobs

- Third-Party Sponsors

- Veterans

- Monthly Payment Plan

- Direct Payments

- Credit-Based Loans

- Applying for the Parent PLUS Loan Tips

What If My Financial Aid and Payments Are More Than My Direct Costs for the Semester?

- First-time Loan Borrowers

- Fall 2020 Timeline: NOW!

- Fall 2020 Timeline: July

- Fall 2020 Timeline: August

- Mountaineer Hub Information

What Is the Mountaineer Hub?

Your connection to:

- Student accounts and billing

- Financial aid and scholarships

- Federal Work-Study employment

- Registrar and academic records

It is critical that students pay attention to notices sent from the Mountaineer Hub because they could be regarding their financial aid or a balance due.

How Will You Hear from Us?

- Emails regarding the above topics are sent from the WVU Mountaineer Hub to students’ WVU MIX email.

- Students can set their MIX emails to forward to personal emails or set it up on their mobile devices. This will make it easier to stay informed of important information, deadlines and additional requirements.

- Students should check their MIX email regularly via their WVU Portal

- Students can view up-to-date information in STAR and should check STAR monthly via their WVU Portal

How Do Parents and Guests Access a Student's Account Information?

Family Educational Rights and Privacy Act of 1974 (FERPA)

- FERPA is a federal regulation that protects the privacy of education records, such as:

- Billing

- Financial aid

- Schedule

- Grades

- We cannot release protected information to anyone other than the student once the student moves into on-campus housing OR attends their first day of class at the University (whichever comes first) unless the student grants proxy access to their account information

The WVU Parent and Guest Portal

- Since they cannot share their student log-in information, students are able to give proxy access to their account

- Students can find detailed instructions on how to grant access to their account on the Parent and Guest Portal website

- Proxy covers access to the student's information online, in person, and over the phone

- Parents should be prepared to provide the passphrase established by the student every time they contact the Mountaineer Hub

The Guest Portal: Logging In

- Go to the Parent and Guest Portal website

- Click on "Log In"

- Log in with the email address and password created when the student set up proxy access

The Guest Portal: Student Information

- Tabs at the top show your profile information and students who have granted you access

- Click on a student to see their menu

- You will only see things the student has given you access to view

- Students can edit the standard expiration date

How Can We Plan for the Fall Bill?

Cost and Resource Planner

- Personalized planners were emailed to MIX and personal email accounts on file for students with a Free Application for Federal Student Aid (FAFSA) submitted or financial aid offered

- Planner helps you estimate direct costs, financial aid and potential out-of-pocket expenses for fall and spring

- Planner only indicates direct costs that will be billed

- If you did not receive one, or wish to review how charges to your major, residence hall, or dining plan may impact your bill, please visit our Cost and Resource Planner page

How and When Can I See My Charges?

Fall Bills

- Avaialable Online

- Students and parents/guests with proxy access can view their charges online for fall in early July

- eBill Notifications

- Students will receive an email with billing statement attached

- The eBill will be sent to the student MIX email for fall in early July

- Only students with a balance due for the semester will receive an eBill

- eBills are sent monthly to students who owe a balance

- July eBill payment is due August 1

- Charges such as tuition and fees, housing, and meals may relfect on your bill depending on selections

- Payments already applied (such as deposits, payment plan payments, third-party scholarships received, etc.) will reflect as payments on the bill

- Authorized aid reflecting on the bill also counts as payment toward the balance due

Charges and Payments

What If Financial Aid Doesn't Cover the Full Balance Due? What Are Other Options?

Scholarships

- Departmental scholarships based on program of study

- Scholarships from your local areas

- Scholarship search engines

- Can only be credited to the student's bill once scholarship payment is received

More information about scholarships is available on our Scholarships page.

College Savings Plan (529, Prepaid College Plan)

- Contact your plan manager for instructions on how to send funds

- Can only be credited to the student's bill once payment is received

Part-Time Student Jobs

- Working 1 to 20 hours per week has been shown to improve time management and GPA

- Helps with indirect costs like books, supplies, and transportation (does not apply directly as a payment to the student's bill).

- Some students are offered Federal Work-Study based on financial need from their FAFSA, but students do not need to have work-study to apply for part-time jobs on and off campus

- Students can search and apply for jobs via Handshake

Third-Party Sponsors

- Vocational rehabilitation, military, employers, etc.

- Please contact your third-party sponsor for more information

Veterans

- Vsit the Center for Veteran, Military and Family Programs website

- Information on benefit types and required documentation can be viewed by selecting "Get started with the GI Bill"

- Start your certification process online by selecting "VA Benefits Intake/Agreement form" on the home page

Monthly Payment Plan

WVU offers a monthly payment plan to help students spread all or a portion of their institutional charges (tuition and fees, and, if living on campus, housing and dining) over several months.

- Break semester bills into as many as six smaller payments (if signed up by May 31 for fall or November 30 for spring)

- Sign up in June to utilize the five-month option for fall (use an estimated balance due and update with the actual amount when bills are available)

- Signing up later means fewer months to pay and larger monthly payments.

- Can help reduce borrowing through loans.

- A $35 enrollment fee plus the first payment are due when you sign up

- It's all online! You can enroll, manage your account, and make payments 24/7. To learn more, visit our Tuition Payment Plan page.

The monthly payment plan is also a great tool to minimize borrowing when possible. For example, perhaps you can't do the plan for your full balance due and intend to pursue credit-based loans to cover your bill. However, you know you can afford to pay $100 a month. You can set up the monthly payment plan for $100 a month and pursue the credit-based loan for the rest of your balance due. This could save you up to $4,800 in loan debt over four years - not including interest! Please note if you are taking a credit-based loan out to receive a refund for books or living expenses, that loan will go toward your balance due first before disbursing a refund (even if you have a monthly payment plan set up). Also, be cognizant of whether or not your credit-based loan starts repayment when determining how much you can afford in a payment plan for the month.

Direct Payments

- Pay online with a check using the routing and bank account numbers for your checking account (fastest and easiest method)

- Pay online with a debit/credit card (2.25% convenience fee)

- Pay with a check, money order, or certified bank check paid to the order of WVU or West Virginia University

More on payment options and instructions for paying online can be found on our Billing page.

Credit-Based Loans

There are credit-based loan options from the federal government and private lenders. Credit-based loans require an application and credit approval. However, there are differences between federal and private loans such as the borrower, the lender, interest rates, fees and terms. We have tools to help you determine what works best for you!

Private Loans

- Interest rate varies by lender

- The borrower could be the student or parent, depending on the lender

- The student usually needs a cosigner

- Visit our Private Loans page for more information, including tips and search resources to help you compare private lenders

Parent PLUS Loans

- Interest fixed at 5.3% for loans that disburse on or after July 1, 2020 and before July 1, 2021

- For parents of dependent undergraduate students

- The loan is in the parent's name

- Visit our Federal Parent PLUS Loan page for more information on applying and frequently asked questions

Applying for the Parent PLUS Loan Tips

To apply for the Parent PLUS Loan, a parent must:

- Go to the Federal Student Aid website

- Log in with the parent Federal Student Aid ID (FSA ID) (not the student's FSA ID)

- Select the 2020-2021 year on the PLUS application

- Ensure the application is sent to West Virginia University

- If approved, you must complete a Loan Agreement (Master Promissory Note) for the PLUS loan on the Federal Student Aid website

- The Department of Education will email instructions if an endorser is needed or Credit Counseling is required

- More information and instructions are available on our Federal Parent PLUS Loan page

What If My Financial Aid and Payments Are More Than My Direct Costs for the Semester?

Financial Aid Refunds

- Financial aid pays toward the student's bill approximately 10 days prior to the start of the semester

- Students can sign up for direct deposit at wvu.afford.com to receive the refund within 4-5 business days of aid disbursement

- Direct deposit refunds are usually received during the first week of classes

- If not signed up for direct deposit, a paper check is mailed

- Students are responsible for charges incurred after a refund has been issued (replacement fees for student IDs, additional tuition charges from registering for more classes, adding a meal plan, etc.)

More information is available on our Refunds page.

Are There Academic Requirements Students Must Meet to Maintain Their Financial Aid From One Year to the Next?

Keep Your Aid!

Students must meet Satisfactory Academic Progress requirements in order to keep their federal and some state financial aid for future academic years.

Students must:

- Have a minimum overall GPA of 2.0 by the end of each spring

-

Earn at least 67% of all hours they attempt by the end of each spring

- Withdrawing from classes after the add/drop period, incompletes and failing classes have a negative impact on this percentage

- Complete their program of study within 150% of the hours required for the program (example: complete a program that requires 120 hours within 180 attempted hours)

In addition to Satisfactory Academic Progress, some types of aid have their own overall GPA and earned hour requirements.

Examples:- Promise and Institutional Scholarships

- Earn 30 credit hours in fall, spring and summer (excluding classes taken in high school) for full-year recipients

- Promise: By end of summer, must have an overall GPA of at least 2.75 after first year and a 3.0 in subsequent years

- Institutional: By end of summer, must have an overall GPA of at least 2.75 (applies to scholarships listed on our Renewal Requirements page)

- WV Higher Education Grant

- Earn 24 credit hours in fall and spring for full-year recipients

- Overall GPA of at least 2.0 at end of spring

- More information is available at the WV Higher Education Grant website

Frequently Asked Questions

- How do I buy textbooks?

- If students have more financial aid than direct costs, they can use their refund to purchase books using the Bookstore Program

- My family's income has reduced significantly since our 2018 taxes. What do I do?

- Visit the Family Contribution Appeal page for instructions on how to request and complete the appeal for 2020-2021 for review.

- Do I have to apply for financial aid every year?

- Yes, students must submit a new Free Application for Federal Student Aid (FAFSA) every year for federal and most state aid consideration. The FAFSA is available October 1 for 2021-2022 and will ask for your 2019 tax information. The priority deadline to submit is March 1, but the earlier the better!

- How do I submit outside scholarships and 529 college savings plan payments to WVU?

- All scholarships and 529 payments should go to the Mountaineer Hub. All payments made to WVU should include the student's name and WVU ID number. Visit our Payments page for detailed instructions and mailing addresses.

- What is the Mountaineer Hub Peer Educator Program?

- This program provides students access to trained student employees who can answer

questions about common financial concerns, including how to complete a FAFSA,

budget for rent, manage loan debt, and more! Students can schedule appointments

on our

Peer Educators page.

What Are Some Next Steps?

First-Time Loan Borrowers

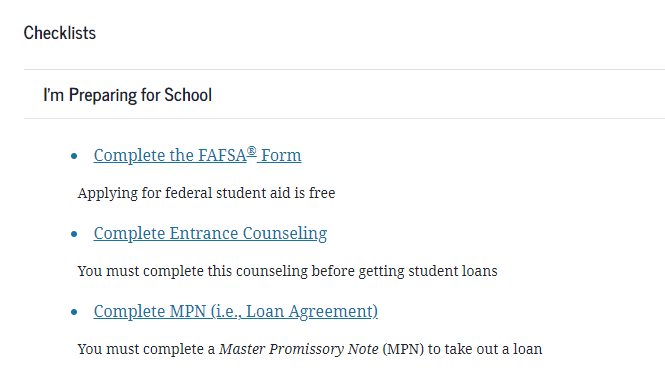

- First-time student loan borrowers (for subsidized and unsubsidized loans) must complete TWO requirements found under My Checklists on the Federal Student Aid website

- Students must log in with their Student Federal Student Aid ID (FSA ID)

- Complete Master Promissory Note (i.e., Loan Agreement)

- Complete Entrance Counseling

Fall 2020 Timeline: NOW!

- Use the "Cost and Resource" planner to estimate out-of-pocket costs for fall and spring

- Sign up for the five-month option of the Tuition Payment Plan

- Parents of dependent undergraduates may apply for a Parent PLUS Loan on the Federal Student Aid website

- First-time student borrowers of federal loans complete their Loan Agreement and Entrance Counseling on the Federal Student Aid website

- June 1: Student health insurance waiver is available on the Student Health Insurance website

- June 29: Last day to select a meal plan on the Dining Services website before it defaults

Fall 2021 Timeline: July

- Sign up for direct deposit of refunds

- On or around July 4:

- Fall charges available online

- Fall eBill sent to MIX emails for students who owe a balance

Fall 2021 Timeline: August

- August 1:

- July eBills due (less displayed aid)

- Student health insurance waiver deadline

- August 2: Late fees assessed on balances of $200 or more (for students who received a July eBill)

- August 5: Last day to reserve books with financial aid through the Bookstore Program

- August 9: Financial aid pays toward fall balance

- August 19: First day of classes

- Refunds are typically available to students signed up for direct deposit.

- August 25: Last day to add/drop 16 week classes

- August 28: Last day students who utilized the Bookstore Program can pick up their reserved books

Mountaineer Hub Information

Visit our Mountaineer Hub Appointments form to schedule your appointment.

- Online Assistance

- Phone: 304-293-1988

- Available Monday through Friday from 8:15 a.m. to 4:45 p.m. ET

- Fax: 304-293-4890

- Mailing Address: P.O. Box 6004, Morgantown, WV 26506

- Location: Evansdale Crossing, 2nd Floor, 62 Morrill Way, Morgantown, WV